BTC Price Prediction: $1M Long-Term Target as Institutional Adoption Accelerates

#BTC

- Technical Strength: BTC trades above key moving averages with improving MACD momentum

- Institutional Adoption: $2B MicroStrategy offering and S&P 500 inclusion signal mainstream acceptance

- Long-Term Valuation: Scarcity model supports million-dollar targets as global adoption accelerates

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amid Consolidation

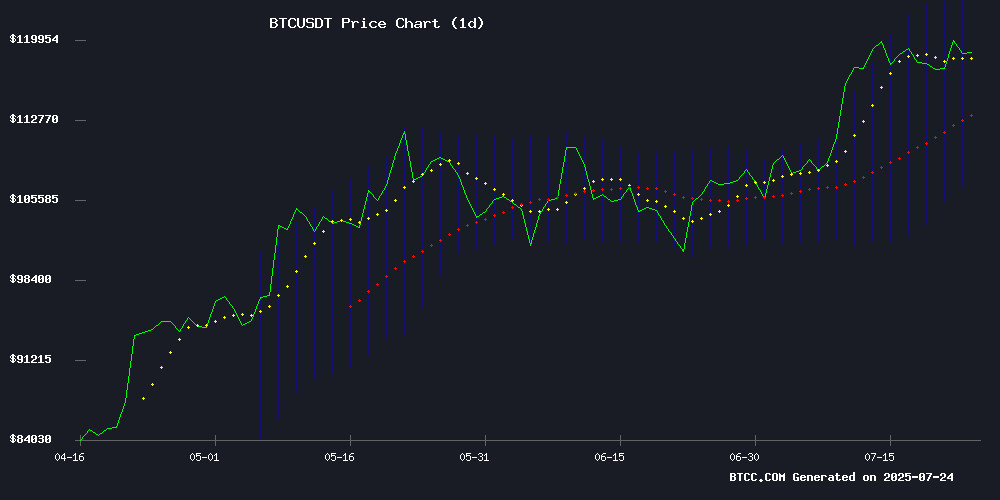

BTCC financial analyst Ava notes that Bitcoin is currently trading at $118,550.94, above its 20-day moving average of $115,947.26, indicating underlying strength. The MACD histogram has turned positive (188.19), suggesting waning bearish momentum. With price hovering near the middle Bollinger Band ($115,947.26) and facing resistance at the upper band ($124,055.75), a breakout could signal the next leg up. 'The technical setup shows accumulation near key levels,' says Ava, 'with $120K acting as a psychological battleground.'

Institutional Demand and Whale Accumulation Fuel Bitcoin Optimism

BTCC's Ava highlights bullish catalysts from recent news: 'MicroStrategy's upsized $2B bitcoin offering and Block's S&P 500 inclusion demonstrate growing institutional conviction. Meanwhile, whale accumulation near $118K suggests smart money isn't deterred by short-term consolidation.' Notable bearish risks include the NYC crypto case potentially affecting regulatory sentiment and short-term resistance at $122K. 'Fundstrat's $1M long-term prediction aligns with our view of structural adoption,' Ava adds.

Factors Influencing BTC's Price

NYC Crypto Torture Case Suspects Granted Million Dollar Bail

William Duplessie and John Woeltz, the two suspects behind New York City’s Bitcoin torture plot, were each granted $1 million bail this week. Judge Gregory Carro approved their release as evidence review continues. Duplessie will be confined to a home in Miami, while Woeltz remains in New York, both required to wear ankle monitors.

The case stems from an incident where a 28-year-old victim alleged he was held captive for weeks in a SoHo townhouse and tortured to relinquish his cryptocurrency. The duo faces charges of coercion, assault, and kidnapping. The case highlights the dark underbelly of crypto-related crime, though no direct market impact is expected.

MicroStrategy Upsizes Bitcoin-Focused Preferred Stock Offering to $2 Billion

MicroStrategy has dramatically expanded its latest capital raise, increasing a planned $500 million preferred stock offering to $2 billion amid surging institutional demand for Bitcoin exposure. The move signals deepening corporate conviction in cryptocurrency as a treasury asset.

The Series A Perpetual 'Stretch' preferred shares (STRC), initially priced at $100, will now debut at $90 with a 9% dividend yield. Despite the discount, overwhelming investor interest prompted the fourfold upsizing—a bullish indicator for Bitcoin's mainstream adoption through traditional financial instruments.

Michael Saylor's firm continues to dominate corporate bitcoin holdings, with this offering structured to outrank previous preferred share classes like 'Strike.' The pricing adjustment reflects sophisticated market dynamics as institutional players increasingly seek regulated pathways into digital assets.

MicroStrategy Quadruples Bitcoin Fundraising Target to $2 Billion Amid BTC Rally

MicroStrategy has dramatically increased its equity sale target to $2 billion, up from its original $500 million goal, to fuel further Bitcoin acquisitions. The move comes as the company's stock surges 42.5% year-to-date, trading NEAR $417.

The Series A Perpetual Preferred Shares offering, priced at $90 per share, is being managed by Morgan Stanley, Barclays, and other major banks. This aggressive fundraising follows MicroStrategy's recent purchase of 4,225 BTC at an average price of $111,827 per coin.

With total holdings now at 601,550 BTC acquired for $42.87 billion, MicroStrategy maintains its position as the largest corporate Bitcoin holder. The company's BTC strategy, initiated in 2020, has driven its stock price up over 3,500%.

Bitcoin Whales Accumulate Despite Price Stalling Near $118K

Bitcoin's price action has been choppy around the $118,000 mark for the past two weeks, yet on-chain data reveals aggressive accumulation by large holders. The cryptocurrency briefly touched a new all-time high of $123,091 on July 14 before entering a consolidation phase above $116,400.

Institutional players—including spot ETF issuers, funds, and corporations—are driving the current rally. CryptoQuant analyst Burak Kesmeci notes retail investors have been net sellers since early 2023, while whales continue building positions. This divergence underscores institutional conviction in Bitcoin's long-term value proposition.

Notably, a Satoshi-era miner moved a significant portion of the $2.7 billion BTC inflows to Binance recently. The muted Google Trends score for Bitcoin suggests retail euphoria remains absent—a stark contrast to previous market tops.

Bitcoin Consolidates at Key $120K Level as Altseason Uncertainty Looms

Bitcoin's price action shows textbook consolidation after its July all-time high, with a negligible 0.06% daily decline suggesting institutional accumulation. The market cap holds steady as institutional validation grows—Genius Group's 10,000-BTC treasury target coincides with Goldman Sachs and BNY Mellon launching tokenized funds.

Technical indicators paint a bullish picture: RSI levels avoid overbought territory while MACD signals maintain upward momentum. This pause at historic highs represents a critical inflection point—either cementing Bitcoin's dominance or accelerating altcoin rotation.

The real tension lies between smart money positioning in BTC and emerging altseason dynamics. Trading ranges remain tight, characteristic of institutional participation rather than retail frenzy.

Fundstrat’s Tom Lee Predicts Bitcoin Could Reach $1 Million in Long-Term

Bitcoin's potential to hit $1 million has been boldly forecasted by Tom Lee, co-founder of Fundstrat Capital. Despite recent price consolidation near $117,000 after reaching an all-time high of $122,000, Lee remains unwavering in his optimism. His conviction stems from Bitcoin's growing reputation as digital Gold and its emergence as a cornerstone of trust in global finance.

The prediction, shared during a CoinDesk interview, has sparked both excitement and skepticism. Lee's long-term outlook underscores Bitcoin's transformative role in the financial landscape, even as critics question the feasibility of such a price target. The flagship cryptocurrency continues to dominate discussions among institutional investors and crypto enthusiasts alike.

Bitcoin Long-Term Holders Signal Potential Market Inflection Point

Bitcoin's price has been range-bound between $115,000 and $120,000 for ten consecutive days, reflecting a period of intense consolidation. The inability of bulls to break the $120,000 resistance level has raised concerns among analysts, who now warn of a possible correction. Market participants are bracing for heightened volatility as technical and on-chain indicators align.

The Monthly Cumulative Days Destroyed (CDD) to Yearly CDD ratio has surged to 0.25, a historically significant level observed during previous market peaks and corrections. This metric, tracked by CryptoQuant, suggests long-term holders are increasingly moving dormant coins—a behavior often associated with profit-taking. The $106,000-$118,000 range has emerged as a critical zone for distribution activity.

While the current trend remains intact, the CDD spike mirrors patterns seen in 2014 and 2019, both periods marked by substantial market shifts. The coming days will test whether Bitcoin can sustain its rally or face a deeper pullback. Analyst Axel Adler notes this distribution phase could represent either a temporary pause or the early stages of a broader reversal.

Bitcoin Tests Key Resistance at $122K Amid Short-Term Bearish Signals

Bitcoin's price action remains tightly range-bound between $116,000 and $119,000, with market participants closely watching the $122,000 resistance level. A breach above this threshold could confirm the next bullish phase, while failure may prolong consolidation or trigger a deeper retracement.

Analysts point to declining spot buying pressure and swelling unrealized profits as warning signs for near-term downside. The Alphractal Power Law chart identifies $122,000 as a make-or-break level that historically separates bull markets from bear trends—a decisive close above this zone WOULD signal robust macro demand.

On-chain metrics reveal troubling liquidity outflows despite recent price stability. The market appears poised for a short-term pullback before any sustained upward movement, with traders watching order book liquidity at key psychological levels.

Arkham Intelligence Debunks U.S. Government Bitcoin Sell-Off Claims

Blockchain analytics firm Arkham Intelligence has refuted rumors that the U.S. government liquidated 85% of its Bitcoin holdings. The firm confirms the government still holds 198,000 BTC, valued at $24 billion as of July 2025. These reserves, spread across agencies like the FBI, DOJ, and DEA, have remained untouched for four months.

Senator Cynthia Lummis had earlier expressed alarm over the alleged sell-off, calling it a strategic blunder. The upcoming TRUMP administration report is expected to address digital asset policy, including the potential for a federal Bitcoin reserve.

Block Joins S&P 500, Amplifying Bitcoin's Institutional Footprint

Jack Dorsey's Block has been added to the S&P 500 index, marking a significant milestone for Bitcoin's institutional adoption. The payments company holds 8,584 BTC—worth approximately $1 billion—making it the 13th-largest corporate holder of the cryptocurrency. Block's inclusion follows similar S&P 500 constituents Coinbase and Tesla, both of which maintain substantial Bitcoin treasuries.

The MOVE exposes S&P 500 index investors to indirect Bitcoin exposure through Block's substantial holdings. Market reaction has been immediate, with Block's NYSE-listed shares surging 14% in the past five days. The $50 trillion index now incorporates three companies with meaningful Bitcoin positions, signaling growing mainstream acceptance.

"Institutional entrance solidifies BTC's financial visibility," observed one market commentator. The development suggests conservative investors may increasingly view Bitcoin as a legitimate reserve asset. Block replaced Hess Corp after its $55 billion merger with Chevron, meeting the index's stringent market capitalization and profitability requirements.

New York Bitcoin Kidnapping Suspects Released on Bail

Two men charged in a high-profile Bitcoin kidnapping case in Manhattan have been granted bail. John Woeltz, 37, and William Duplessie, 33, each received $1 million bail after allegedly abducting and torturing an Italian bitcoin trader to extract his cryptocurrency credentials.

The victim, a 28-year-old visitor to New York, endured weeks of captivity in a Manhattan townhouse where he was subjected to beatings, electric shocks, and death threats. Prosecutors allege the assailants pistol-whipped the trader and threatened his family while demanding access to his bitcoin wallet. The ordeal ended in late May when the victim escaped after convincing his captors to let him use a laptop.

Both defendants pleaded not guilty to charges including kidnapping, assault, and coercion. Bail conditions require electronic monitoring and passport surrender ahead of their October 15 court date. The case highlights the dark intersection of cryptocurrency wealth and violent crime in major financial hubs.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $150K | $250K | ETF inflows, halving effects |

| 2030 | $300K | $500K | Institutional adoption, scarcity premium |

| 2035 | $700K | $1M | Global reserve asset status |

| 2040 | $1.5M | $3M+ | Network effects, monetary paradigm shift |

Ava projects Bitcoin could reach $250K by 2025 if current institutional demand persists, noting 'Each halving cycle has historically delivered 3-5x returns from cycle lows.' By 2030-2035, she anticipates acceleration from network effects: 'Bitcoin's fixed supply becomes increasingly meaningful as adoption grows exponentially.' The $1M+ 2040 targets assume Bitcoin captures 10-20% of global store-of-value markets.